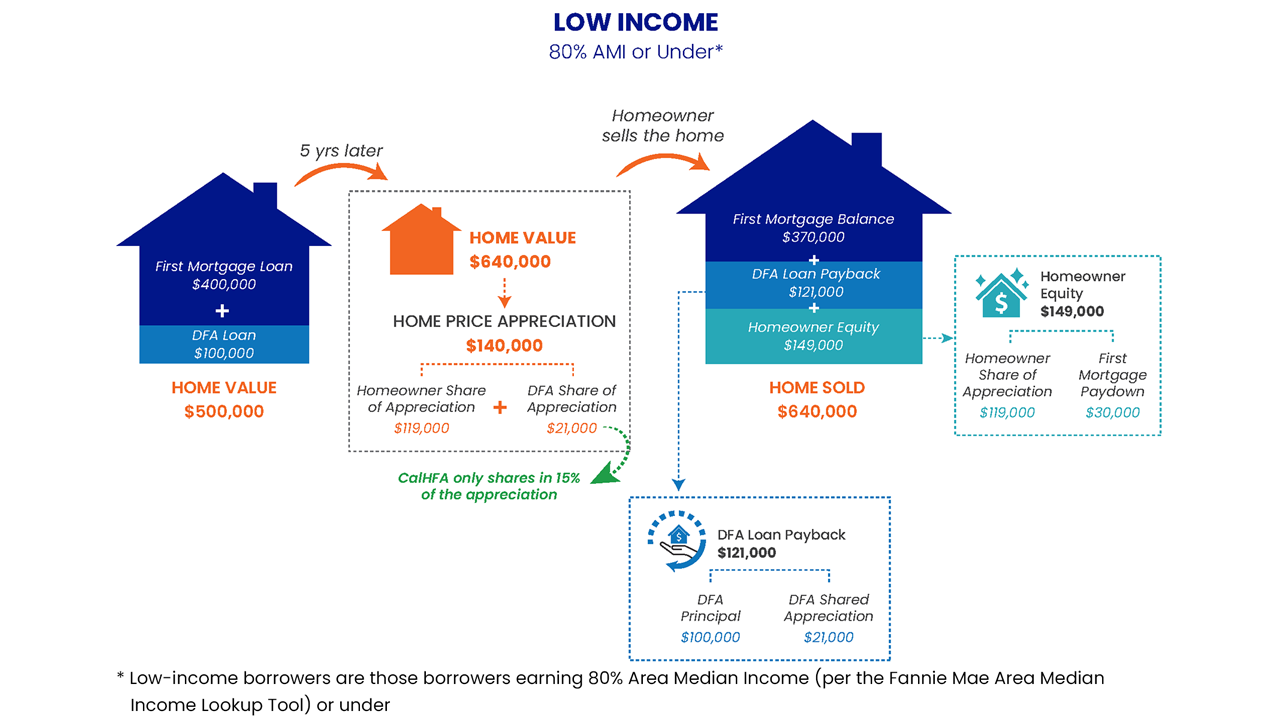

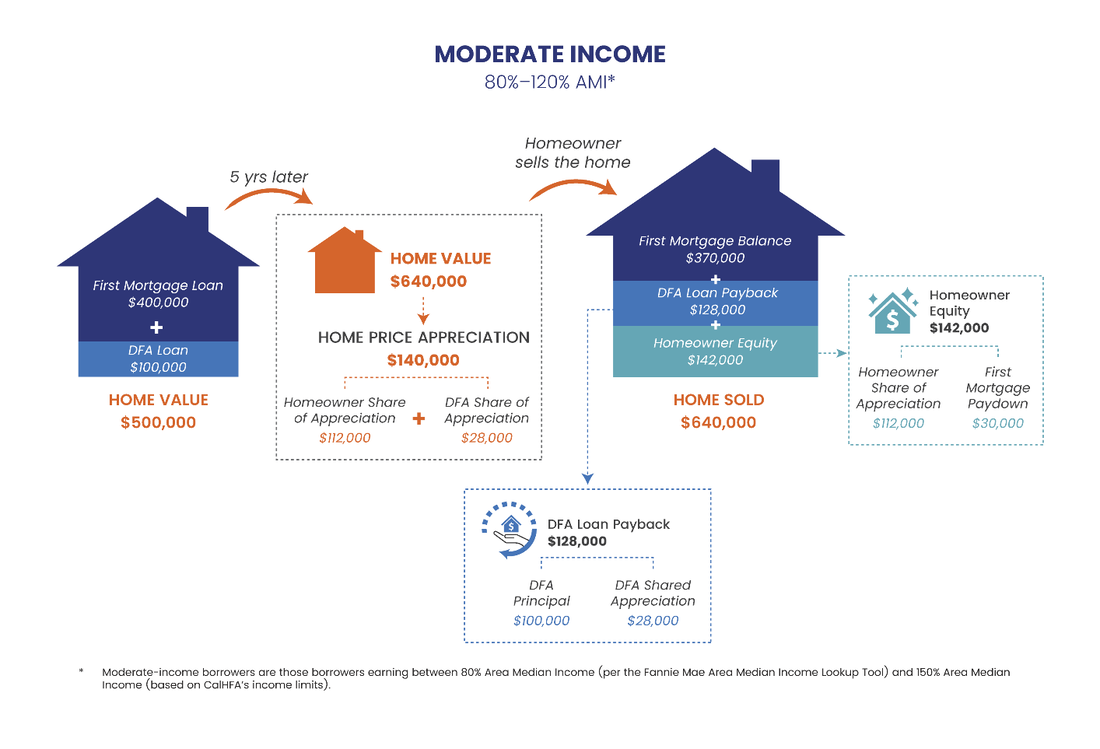

The Dream For All Shared Appreciation Loan is a down payment assistance program for first-time homebuyers to be used in conjunction with the Dream For All Conventional first mortgage for down payment and/or closing costs. Upon sale or transfer of the home, the homebuyer repays the original down payment loan, plus a share of the appreciation in the value of the home. Shared Appreciation Shared Appreciation is a little more complex than a typical mortgage loan, so we’ve put together a few examples for you. Shared Appreciation Examples: Example #1 Borrower is a CalHFA income homebuyer

Example #2 Borrower income less than or equal to 80% AMI using the HomeReady Lookup Tool

Current Mortgage Rates

February 3, 2023 Purchase Los Angeles County 80% financing Jumbo 30 year fixed 6.375% APR 6.412 Jumbo 7/1 ARM 5.875% APR 5.974 Purchase Los Angeles County 80% financing Conforming 30 year fixed 6.5% APR 6.524 Conforming 7/1 ARM 6% APR 6.024 2023 RECAP:

There are two big real estate takeaways from 2023: 1) Interest rates went through the roof. 2) The number of homes for sale continued to languish at all-time record lows. If you were a Buyer in 2023, you had a very tough year. Interest rates soared to as high as 8% yet home prices continued to rise. Surprisingly, median home prices rose about 4% from the year before. If you were a homeowner in 2023, you likely decided not to sell unless you absolutely had to. Most homeowners refinanced their home loans when interest rates were at record low rates of 3% or less. If you thought about selling, you quickly realized that after you sold, the interest rate on your new loan would be double or triple. As a result, some homeowners probably feel a bit trapped in their homes. They'd like to sell but the idea of a much higher interest rate with a much higher monthly payment is a deal breaker. My thought is that this situation has created what I call "pent-up seller demand" which isn't an official term but hopefully, you get the idea. IS CHANGE IN THE AIR? In the last few months of 2023, the interest rates started to come down a bit. The current interest rate is about 6.375% and interest rates are predicted to continue to go down during 2024. How low will rates go? Unfortunately, my crystal ball is not crystal clear on that detail. In the past few months, there has been a slight uptick in the number of homes for sale and the average SOLD price has also decreased just a bit. It's too soon to tell if this is the beginning of a trend or just a blip on the radar. If interest rates continue to come down, that might help more Sellers who were on the fence, decide to sell. BOTTOM LINE: It seems most likely that in 2024 could be the beginning of a turnaround for Buyers. - Interest rates trending down - More Sellers deciding to sell - Home values stabilizing (and maybe even trending down a bit) *NOTE: As of January 5th, 2024, the 30-year, fixed rate conforming loan ($766,550 max loan principle) = 6.375% |

AuthorThe Fitzburgh Realty Team Archives

March 2024

Categories |

The Fitzburgh Realty Team - Glassell Park Real Estate - Northeast Los Angeles Realtor

- Home

- About Us

- RE Videos

- Search Homes

-

Homes Fur All

- Explore NELA >

- News

- Super A Test

- Bark & Meow Fan Club

- Concerts in the Park

- Eagle Rock Bark >

- Glassell Bark >

- Glassell Park Easter Egg Hunt

- GLASSELL PARK TREE LIGHTING >

- Growing Caring Sharing News

- 4 Weeks 4 Life

- Fostering Resources

- Pet Food Drive

- Pet Resource Guide

- Pet Adoption Hall of Fame

- Spread The Word

- Super Party >

-

Resources

- Brian's Blog

- Contact us

REACH OUT to BRIAN and ZACH DIRECTLY

2022 Zillow Premier 5 Star Agent in Los Angeles. Parrish Ave., Los Angeles, CA. CalDRE# 01875767. Copyright © 2022 Brokers Trust Real Estate Group. All Rights Reserved.

RSS Feed

RSS Feed