The Fed left rates unchanged at their meeting last week. This followed news that inflation at both the consumer and wholesale levels continued to cool in November. Here are the headlines:

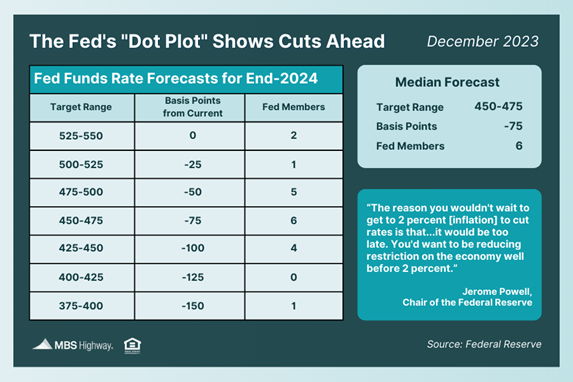

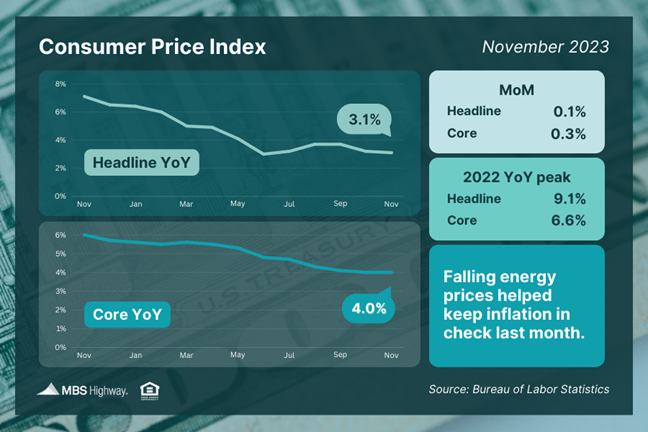

Fed Pivots, Signals Rate Cuts Are Ahead After eleven rate hikes since March of last year, the Fed once again left their benchmark Federal Funds Rate unchanged at a range of 5.25% to 5.5%. This decision was unanimous and followed similar pauses taken at their September and November meetings. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. The Fed has been aggressively hiking the Fed Funds Rate throughout this cycle to try to slow the economy and curb the runaway inflation that became rampant last year. What’s the bottom line? At his press conference following the meeting, Fed Chair Jerome Powell acknowledged the “very good news” that “inflation has eased from its highs,” though he noted that ongoing progress “is not assured.” While the Fed did not rule out additional rate hikes if warranted to keep inflation in check, last week’s meeting suggested that rate cuts are ahead next year. The “dot plot” of Fed member forecasts for where policy rates will be in a year showed that 15 out of 19 members expect cuts between 50 and 100 basis points over the course of next year. Continued Progress on Consumer Inflation November’s Consumer Price Index (CPI) showed that inflation rose 0.1% compared to October, just above the consensus estimate of a flat reading. On an annual basis, CPI fell from 3.2% to 3.1%, near the lowest level in more than two years. Core CPI, which strips out volatile food and energy prices, increased 0.3% while the annual reading remained at 4%, a two-year low.

Declining energy prices helped keep inflation in check last month, even in the face of rising costs for used cars, motor vehicle insurance, and health insurance. What’s the bottom line? Inflation has made significant progress lower after peaking last year, with the headline reading now at 3.1% (down from 9.1%) and the core reading at 4% (down from 6.6%). The Fed will be closely watching for further progress on inflation as they consider pivoting to rate cuts next year. Wholesale Inflation Also Cooled The Producer Price Index (PPI), which measures inflation on the wholesale level, was flat in November. On an annual basis, PPI declined from a downwardly revised 1.2% to 0.9%, which was lower than expected. Core PPI, which also strips out volatile food and energy prices, was flat for the month with the year-over-year reading down from 2.3% (also downwardly revised) to 2%. What’s the bottom line? This latest PPI report is another encouraging sign that inflation is easing, with November’s 0.9% year-over-year reading a sharp drop from last year’s 11.7% peak. Plus, PPI tends to lead the way for CPI, which suggests further good progress moving forward. Retail Sales Stronger Than Expected After falling in October, Retail Sales rebounded in November, with the 0.3% rise coming in above expectations of a 0.2% decline. Sales were also up 4.1% when compared to November 2022. What’s the bottom line? While slumping energy prices caused a decline in sales at gasoline stations, lower gas prices also freed up money for consumers to spend on other items. In fact, Retail Sales rose across most categories last month, with online shopping especially seeing a boost as sales at non-store retailers rose 1%. Overall, the data shows there was a strong start to the holiday shopping season as inflation continues to ease. Initial Jobless Claims at 2-Month Low Initial Jobless Claims fell by 19,000 in the latest week, with 202,000 people filing for unemployment benefits for the first time. Continuing Claims rose by 20,000, showing that 1,876,000 million people are still receiving benefits after filing their initial claim. What’s the bottom line? The low number of Initial Jobless Claims suggests that layoffs remain muted as employers are trying to hold on to workers. Yet, Continuing Claims reached their second highest level since November 2021. This figure has been rising sharply and points to a weakening labor market, where it’s much harder for people to find employment once they are let go. What to Look for This Week Look for a plethora of housing data starting Monday with builder confidence for this month from the National Association of Home Builders. November’s Housing Starts and Building Permits will be reported on Tuesday, followed by Existing Home Sales on Wednesday and New Home Sales on Friday. Thursday brings the latest Jobless Claims, the final reading for third quarter GDP and regional manufacturing data from the Philadelphia Fed Index. Ending the week on Friday, look for Personal Consumption Expenditures, the Fed’s favored inflation measure. Technical Picture Mortgage Bonds have had a beautiful rally over the last two months and are now significantly above their 200-day Moving Average. They ended last week squeezed in a narrow range between support at the 101.392 Fibonacci level and overhead resistance at 101.61. The 10-year ended the week trading around 3.91% and has room to move lower until reaching the next floor of support. Change is coming to the real estate business following a big legal win for home sellers. An October jury ruling against the nation's largest trade organization could have sweeping consequences for anyone looking to buy or sell a home. The class-action lawsuit – Sitzer v. the National Association of Realtors – alleged that NAR, Keller Williams Realty, Anywhere Real Estate (formerly known as Realogy), RE/MAX and HomeServices of America (all major real estate brokerages), colluded to artificially inflate agent commissions. RE/MAX and Anywhere Real Estate (formerly known as Realogy) earlier this year settled out of court for a combined $140 million. A jury ultimately sided against the remaining defendants on Oct. 31, awarding a judgment of $1.8 million that could, depending on the judge’s decision, surge to over $5 billion in total damages. “They ultimately agreed that there was a conspiracy among Realtors to keep their fees artificially high,” says Omar Ochoa, a class action attorney and founder of Omar Ochoa Law Firm in Texas. It’s just the latest hit for the 1.5-million-member group of real estate agents, which has recently faced several lawsuits (including one from the Department of Justice) regarding harassment accusations, executive shuffles and a surge of pullouts from big-name brokerages, like RE/MAX, Century 21, Redfin and more. It also has the power to forever change what it costs to buy and sell real estate. As Richard Kruse, an agent with Gryphon Realty in Columbus, Ohio, and former member of NAR, puts it, “The fight will go on and an appeal will be filed and drag this out, but eventually agent payments will change.” What Was the NAR Lawsuit About? It’s a little complicated, but the basis of the NAR lawsuit boils down to the group’s commission-sharing rule. To list a for-sale property on a multiple listing service – the databases that agents use to share properties amongst themselves – they must offer a commission to the agent who ultimately brings in the winning buyer. Historically, this has resulted in a 5% to 6% commission, with half going to the seller’s agent and half to the buyer’s. Here’s the catch, though: The buyer doesn’t pay their agent’s fee directly. Instead, the commission is fully paid by the seller as part of their closing costs. According to the Sitzer suit, as well as other litigation, this amounts to a form of antitrust, reducing competition and pushing up commissions higher than services warrant. “The jurors were convinced by the plaintiffs’ attorneys that an environment of collusion existed with the industry, enabled by NAR’s practices, and that buyers should be free to negotiate fee structures separate from that established in listing agreements with sellers,” says Budge Huskey, CEO and president of Premier Sotheby’s International Realty in Naples, Florida. (To be clear: Huskey does not agree with the jury’s verdict.) What’s Next? While the jury has ruled in the Sitzer case, the judge, Stephen Bough, has yet to finalize damages. Once he does, those damages will be divvied out among the thousands of home sellers who participated in the class action lawsuit. That may take a while, though, as Kruse suggested, NAR plans to appeal the decision. “This matter is not close to being final as we will appeal the jury’s verdict, and we remain confident we will ultimately prevail,” NAR president Tracy Kasper said in a statement. “Due to the nature of appeals, this case likely will not be concluded for several years.” There’s a chance the case could be settled outside of court before those appeals wind through the courts. As Ochoa explains, “They're going to continue to fight the amount awarded, liability, that the class isn't a proper class or whatever kind of legal means that they can do to unwind the judgment either altogether or at least substantially reduce it. While all that's going on, generally speaking, the parties are probably going to discuss settling the case. It may be in their interest to reach some resolution instead of waiting for years for the judgment to make its way through the appellate system.” What It Means for Buyers and Sellers

Eventually, the lawsuit may lead to changes in how agent commissions are set and paid out. According to Kruse, the commission-sharing model could evolve into a referral fee system. “In my opinion, there will be something in the form of a referral fee from the listing agent to the buyer agent for introducing the buyer to the property,” he says. It could also mean an end to commission sharing altogether. A recent report from consulting firm Keefe, Bruyette & Woods projects this “unbundling” could occur as early as 2024. It could result in commission decreases as much as 2 percentage points or more. “The new buzzword for real estate will be ‘decoupling,’” says Sissy Lappin, a real estate agent and co-founder of ListingDoor in Houston. “The seller will pay their agent and the buyer will pay theirs.” How that decoupling will play out is uncertain. Some experts say buyer’s agents may resort to flat fees or hourly rates. Others say variable fees may be more fitting, as services and time spent with each consumer can vary widely. “There may be a variable buyers' agent fee that is determined when a buyer goes under contract or how many showings they've requested and viewed,” says Steve Nicastro, a real estate agent and content lead at Clever Real Estate in Charleston, South Carolina. “This could better align pay with the work required from buyer's agents. For example, imagine a scenario where a homebuyer pays an agent $50 to $100 per house showing, and then another fixed rate for specific services related to completing the transaction – finding and hiring home inspectors, appraisers, attorneys, etc.” Nicastro says there could also be a larger move toward using real estate attorneys – rather than agents – or more buyers going it alone entirely. That all remains to be seen, though. In the meantime, consumers can likely expect more transparency as they go about buying and selling properties. In fact, in the wake of recent litigation, NAR has already released guidance that Realtors should no longer market their buy-side services as “free” and that shared commissions must be “disclosed openly.” As Laura Ellis, president of residential sales at Chicago-based real estate firm Baird & Warner, explains, “At its core, this issue is about being transparent, taking responsibility and earning consumers' trust.”

Recent Updates to ADU Laws

in California Recent California legislative bills have paved the way for changes in the housing market, as the state grapples with a severe housing shortage. Assembly Bill 1033 (AB 1033) and Assembly Bill 976 (AB 976) which were both signed by Governor Newsom this week, may have substantial implications for Accessory Dwelling Units (ADUs), also known as "granny flats" throughout the state of California. Here's a breakdown of the key provisions in these bills: AB 1033 - ADUs Sold Separately What it Does: AB 1033 enables property owners in select cities to construct ADUs on their property and sell them independently, akin to condominiums. The Workings: Owners building ADUs must notify local utilities about the creation and separate conveyance of these units. A homeowners association must be established to manage the maintenance costs of shared spaces and the property's exterior. Property taxes for the primary residence and the ADU will be billed separately. The Goal: AB 1033 could increase what some refer to as gentle density in many cities - ie the development of single-family type units (e.g., ADUs, duplexes, etc.) within single-family zoned neighborhoods. Gentle density helps maintain the residential façade and aura of neighborhoods while assisting in the offsetting of the growing housing crisis. The passing of AB 1033 could additionally provide more affordable for-sale housing opportunities for low-mid income first-time homeowners. AB 976 - Removes Owner-Occupancy Requirement What it Does: AB 976 will permanently extend the ability of property owners to build rental accessory dwelling units (ADUs) in addition to removing any owner-occupancy requirements. The Workings: The Bill removes owner-occupancy requirements that prohibited ADU construction unless the owner lived in either the main house, or the ADU. When owner-occupancy requirements were temporarily removed in 2017, ADU construction grew massively, resulting in thousands of new rental homes across California. The Goal: This change allows ADUs to be used strictly for rental purposes, with the goal of expanding the rental housing market in California. Additionally, removing owner-occupancy requirements could facilitate the process for owners to use loans or their home equity to add ADUs to their existing properties. In Closing These legislative changes have the potential to substantially impact the housing landscape in California. While some critics argue that these laws may curtail the regulatory authority of local jurisdictions, proponents view them as critical for increasing housing supply and affordability. These laws aim to facilitate more accessible and cost-effective housing options for a wide spectrum of residents, from retirees looking to augment their income to young families aspiring to acquire their first home. With the passing of these two bills, California is slowly but surely taking steps toward addressing its housing challenges to foster a more promising future for its residents. This article is provided for informational purposes only and should not be considered legal advice. The information provided is subject to change at any time without notice. |

AuthorThe Fitzburgh Realty Team Archives

March 2024

Categories |

The Fitzburgh Realty Team - Glassell Park Real Estate - Northeast Los Angeles Realtor

- Home

- About Us

- RE Videos

- Search Homes

-

Homes Fur All

- Explore NELA >

- News

- Super A Test

- Bark & Meow Fan Club

- Concerts in the Park

- Eagle Rock Bark >

- Glassell Bark >

- Glassell Park Easter Egg Hunt

- GLASSELL PARK TREE LIGHTING >

- Growing Caring Sharing News

- 4 Weeks 4 Life

- Fostering Resources

- Pet Food Drive

- Pet Resource Guide

- Pet Adoption Hall of Fame

- Spread The Word

- Super Party >

-

Resources

- Brian's Blog

- Contact us

REACH OUT to BRIAN and ZACH DIRECTLY

2022 Zillow Premier 5 Star Agent in Los Angeles. Parrish Ave., Los Angeles, CA. CalDRE# 01875767. Copyright © 2022 Brokers Trust Real Estate Group. All Rights Reserved.

RSS Feed

RSS Feed