The Fed left rates unchanged at their meeting last week. This followed news that inflation at both the consumer and wholesale levels continued to cool in November. Here are the headlines:

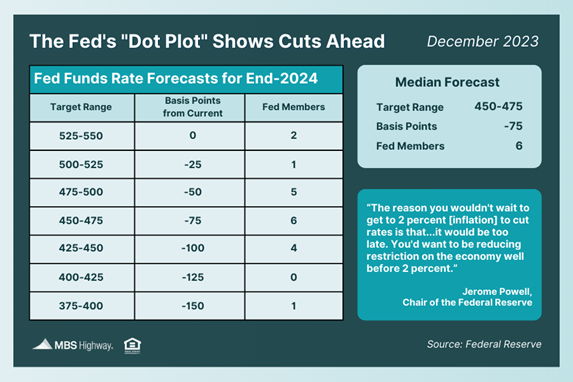

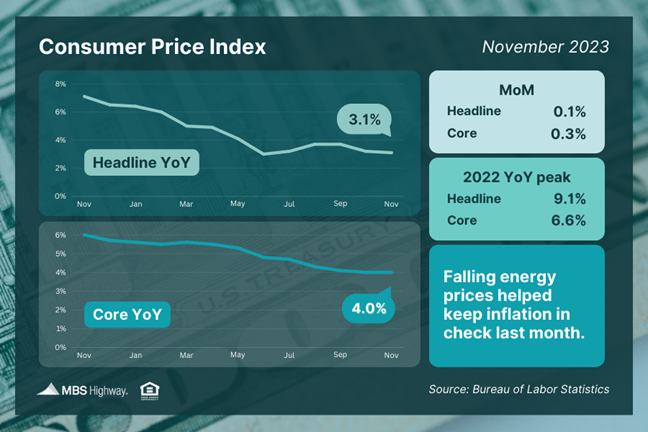

Fed Pivots, Signals Rate Cuts Are Ahead After eleven rate hikes since March of last year, the Fed once again left their benchmark Federal Funds Rate unchanged at a range of 5.25% to 5.5%. This decision was unanimous and followed similar pauses taken at their September and November meetings. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. The Fed has been aggressively hiking the Fed Funds Rate throughout this cycle to try to slow the economy and curb the runaway inflation that became rampant last year. What’s the bottom line? At his press conference following the meeting, Fed Chair Jerome Powell acknowledged the “very good news” that “inflation has eased from its highs,” though he noted that ongoing progress “is not assured.” While the Fed did not rule out additional rate hikes if warranted to keep inflation in check, last week’s meeting suggested that rate cuts are ahead next year. The “dot plot” of Fed member forecasts for where policy rates will be in a year showed that 15 out of 19 members expect cuts between 50 and 100 basis points over the course of next year. Continued Progress on Consumer Inflation November’s Consumer Price Index (CPI) showed that inflation rose 0.1% compared to October, just above the consensus estimate of a flat reading. On an annual basis, CPI fell from 3.2% to 3.1%, near the lowest level in more than two years. Core CPI, which strips out volatile food and energy prices, increased 0.3% while the annual reading remained at 4%, a two-year low.

Declining energy prices helped keep inflation in check last month, even in the face of rising costs for used cars, motor vehicle insurance, and health insurance. What’s the bottom line? Inflation has made significant progress lower after peaking last year, with the headline reading now at 3.1% (down from 9.1%) and the core reading at 4% (down from 6.6%). The Fed will be closely watching for further progress on inflation as they consider pivoting to rate cuts next year. Wholesale Inflation Also Cooled The Producer Price Index (PPI), which measures inflation on the wholesale level, was flat in November. On an annual basis, PPI declined from a downwardly revised 1.2% to 0.9%, which was lower than expected. Core PPI, which also strips out volatile food and energy prices, was flat for the month with the year-over-year reading down from 2.3% (also downwardly revised) to 2%. What’s the bottom line? This latest PPI report is another encouraging sign that inflation is easing, with November’s 0.9% year-over-year reading a sharp drop from last year’s 11.7% peak. Plus, PPI tends to lead the way for CPI, which suggests further good progress moving forward. Retail Sales Stronger Than Expected After falling in October, Retail Sales rebounded in November, with the 0.3% rise coming in above expectations of a 0.2% decline. Sales were also up 4.1% when compared to November 2022. What’s the bottom line? While slumping energy prices caused a decline in sales at gasoline stations, lower gas prices also freed up money for consumers to spend on other items. In fact, Retail Sales rose across most categories last month, with online shopping especially seeing a boost as sales at non-store retailers rose 1%. Overall, the data shows there was a strong start to the holiday shopping season as inflation continues to ease. Initial Jobless Claims at 2-Month Low Initial Jobless Claims fell by 19,000 in the latest week, with 202,000 people filing for unemployment benefits for the first time. Continuing Claims rose by 20,000, showing that 1,876,000 million people are still receiving benefits after filing their initial claim. What’s the bottom line? The low number of Initial Jobless Claims suggests that layoffs remain muted as employers are trying to hold on to workers. Yet, Continuing Claims reached their second highest level since November 2021. This figure has been rising sharply and points to a weakening labor market, where it’s much harder for people to find employment once they are let go. What to Look for This Week Look for a plethora of housing data starting Monday with builder confidence for this month from the National Association of Home Builders. November’s Housing Starts and Building Permits will be reported on Tuesday, followed by Existing Home Sales on Wednesday and New Home Sales on Friday. Thursday brings the latest Jobless Claims, the final reading for third quarter GDP and regional manufacturing data from the Philadelphia Fed Index. Ending the week on Friday, look for Personal Consumption Expenditures, the Fed’s favored inflation measure. Technical Picture Mortgage Bonds have had a beautiful rally over the last two months and are now significantly above their 200-day Moving Average. They ended last week squeezed in a narrow range between support at the 101.392 Fibonacci level and overhead resistance at 101.61. The 10-year ended the week trading around 3.91% and has room to move lower until reaching the next floor of support. |

AuthorThe Fitzburgh Realty Team Archives

March 2024

Categories |

The Fitzburgh Realty Team - Glassell Park Real Estate - Northeast Los Angeles Realtor

- Home

- About Us

- RE Videos

- Search Homes

-

Homes Fur All

- Explore NELA >

- News

- Super A Test

- Bark & Meow Fan Club

- Concerts in the Park

- Eagle Rock Bark >

- Glassell Bark >

- Glassell Park Easter Egg Hunt

- GLASSELL PARK TREE LIGHTING >

- Growing Caring Sharing News

- 4 Weeks 4 Life

- Fostering Resources

- Pet Food Drive

- Pet Resource Guide

- Pet Adoption Hall of Fame

- Spread The Word

- Super Party >

-

Resources

- Brian's Blog

- Contact us

REACH OUT to BRIAN and ZACH DIRECTLY

2022 Zillow Premier 5 Star Agent in Los Angeles. Parrish Ave., Los Angeles, CA. CalDRE# 01875767. Copyright © 2022 Brokers Trust Real Estate Group. All Rights Reserved.

RSS Feed

RSS Feed